Customs Broker Modernization Regulations

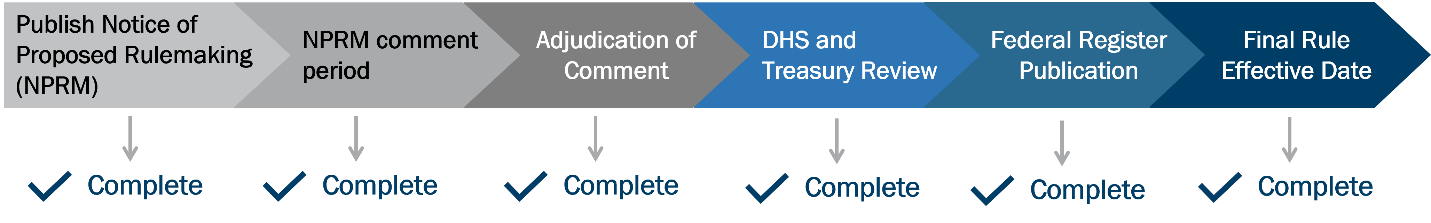

CBP published two Final Rules on October 18, 2022, Modernization of the Customs Broker Regulations (87 FR 63267) and Elimination of Customs Broker District Permit Fee (87 FR 63262). The Final Rules are effective as of December 19, 2022. These rules modernize the customs broker regulations, provide resource optimization for both industry and CBP, and update compliance requirements to protect revenue and strengthen CBP’s knowledge of importers.

By way of background, the Customs broker regulations in part 111 of title 19 of the Code of Federal Regulations (19 CFR part 111) have been subject to review by CBP, the broker community, and the Commercial Customs Operations Advisory Council (COAC) for several years. In April 2016 the COAC Broker Regulations Working Group (BRWG) made 37 recommendations to modernize 19 CFR part 111. On June 5, 2020, CBP published two Notices of Proposed Rulemaking (NPRMs) reflecting many of the COAC recommendations and proposing changes to align the broker regulations with contemporary business practices in the electronic environment.

In the publication of the Final Rules, CBP took into consideration all public comments received in response to the NPRMs.

Customs Broker Modernization Regulations (19 CFR 111) Key Changes

Key Changes Highlights

Key changes include:

New Term and Definition of “Processing Center"

- The Processing Center means the broker management operations of a CBP Center of Excellence and Expertise (Center) that process applications for a broker's license, applications for a national permit for an individual, partnership, association, or corporation, as well as submissions required in Part 111 for an already-licensed broker.

- Center personnel (Broker Management Officers) at any of the 41 port locations will continue to process applications and submissions based on the location through which the broker received/will receive their license and national permit.

Transitioning to a National Permit Framework

- CBP eliminated broker districts and district permits.

- District permit holders without a national permit were automatically transitioned to a national permit before the Final Rule effective date on 12/19/22.

- The national permit allows the broker to conduct customs business on a national scope.

- The national permit eliminates permit waivers and simplifies permit management.

Broker Fee Changes and Electronic Payment

- CBP increased the license application fee from $200 per application to $300 for individual license applications and $500 for organization license applications to recover some of the costs associated with the processing of applications and to better align the processing expenses with the application types.

- CBP allows for electronic submission of broker applications and fees. Payment and submission of the broker exam fee and application and the triennial fee and report have been deployed in the eCBP portal. Additional applications and fees are planned for future eCBP development.

Customs Business within the U.S. Customs Territory and Knowledgeable Point of Contact

- CBP’s practice of requiring customs business to be conducted within the customs territory of the United States is now codified in the regulation.

- Brokers must designate a knowledgeable point of contact to be available to CBP during and outside of normal operating hours to respond to customs business issues (24/7 POC).

Broker/Client Relationship

- Brokers must execute a customs power of attorney directly with the importer of record or drawback claimant (client), and not via a freight forwarder or other (unlicensed) third party, to transact customs business for that client.

- Brokers must advise the client on the proper corrective actions required in the case of noncompliance or an error or an omission on the client's part and retain a record of their communication with the client.

Responsible Supervision and Control Requirements

- CBP added three Responsible Supervision and Control factors in regulation, increasing the factors from 10 to 13.

- CBP may consider the listed Responsible Supervision and Control factors to the extent any are relevant to a specific broker when determining what is necessary to perform and maintain responsible supervision and control.

- A sole proprietorship, partnership, association or corporation must employ a sufficient number of licensed brokers, the number of which may depend on multiple factors, such as the size of the broker entity, the skills and abilities of the employees and supervising employees, and the complexity and similarity of tasks.

- At the time of permit application, brokers must provide a supervision plan for exercising responsible supervision and control over their customs business, which will be unique to each broker and depend, among other things, on the size of a brokerage, the complexity of the customs business, and the types of transactions handled.

Cyber Security and Records Requirements

- Brokers must maintain original records, including electronic records, within the U.S. customs territory.

- Brokers must notify CBP when there has been a breach of electronic or physical broker records and provide any compromised importer of record numbers.

- Regulatory revisions to records confidentiality allows brokers to share client information with third parties when authorized in writing by the client.

Broker Reporting and the Electronic Data Interface (ACE)

- CBP modernized the regulations to allow brokers to transmit the following information via an ACE portal account:

- Information on new and terminated employees

- Office of record and recordkeeping address information

- Recordkeeping point of contact information

- Knowledgeable 24/7 point of contact information

- If the ACE portal is not available, the information must be submitted to the processing Center.

- CBP eliminated the requirement to report an employee’s prior employer(s) and prior home address(s).

Broker Exams and License Changes

- CBP may provide exam results to examinees electronically.

Employee Reporting Guidance

- Pursuant to 19 CFR 111.28(b)(1), after initial submission of a complete employee list, brokers must provide any updates to the required information within 30 days of the change.

- Pursuant to 19 CFR 111.28(b)(2) and (3), brokers must submit new and terminated employee information within 30 days of employment or termination.

- All updates must be submitted through the broker’s Automated Commercial Environment (ACE) Portal account or, if a broker does not have an ACE Portal account, in writing to the processing Center.

CBP allowed brokers until April 14, 2023 to ensure that a list of persons currently employed and updated with required information changes was submitted to CBP. Brokers with legitimate needs for additional time to comply with the employee reporting requirements must submit a request to the Broker Management Branch (brokermanagement@cbp.dhs.gov) explaining their situation and how much additional time is needed.

- Brokers with an ACE Portal account were required to satisfy this requirement by submitting an up-to-date and accurate list of employees in the ACE portal no later than April 14, 2023.

- Brokers without an ACE Portal account were required to submit a current employee list in writing to the processing Center no later than April 14, 2023.

Refer to the ACE Quick Reference Card for guidance on adding employees through an ACE Portal account. If you would like to apply for an ACE Portal account please see the information at Applying for an ACE Secure Data Portal Account.

CBP issued CSMS messages to provide the trade community with guidance on the Adding/Uploading Feature in Modernized ACE, and updates on fixes for the Broker Employee Reporting Functionality in Modernized ACE. For more details, please see CSMS# 54657364, CSMS# 54964247, CSMS #54387706, CSMS #54952300, CSMS #55845210, and CSMS #5588809.

Powers of Attorney Requirements Guidance

As of February 17, 2023, brokers holding powers of attorney (POA) for active clients must satisfy the requirements identified in the Modernization of the Customs Broker Regulations Final Rule (87 FR 63267) under 19 CFR 111.36(c)(3). Brokers should ensure that a POA has been directly executed with an importer of record or drawback claimant (client), and not through a freight forwarder or other (unlicensed) third party, in order to transact customs business for the client.

- If the broker holds a POA that was executed and signed by a freight forwarder or other third party on behalf of the client, the broker must execute a new POA with the client that meets the Modernization of the Customs Broker Final Rule requirements.

- If the broker holds a POA signed by the client, however, the broker did not execute the POA through direct communication with the client, the broker may affirm the existing POA via direct communication with the client or may execute a new POA through direct communication with the client in order to comply with the new requirement.

Brokers executing a POA on or after December 19, 2022 must comply with the requirements in 19 CFR 111.36(c)(3) established by the Final Rule. These requirements include the following:

- Brokers must directly execute a POA with the client in order to transact customs business.

- An agent or third-party cannot serve as a barrier to communications between brokers and the client; however, the client may have an agent or third-party assist in executing the POA, for example by: providing translation services; providing counsel in reviewing the POA terms; or providing courier services to relay a written POA.

In addition, a Broker A-Broker B relationship is not prohibited by the new requirements as long as the client authorizes it broker (Broker A) to allow other brokers (Broker B) to transact any portion of the customs business conducted on behalf of the client. For further information on the Broker A-Broker B relationship, see the Customs Broker Guidance for the Trade Community publication.

Additional Resources

National Permit Transition Process

The Final Rules eliminated district permits and allow all customs brokers to operate under a single national permit. During the 60 days between Final Rule publication on October 18, 2022 and the Final Rule effective date on December 19, 2022, CBP transitioned all customs brokers operating solely under a district permit to a national permit. CBP cancelled all active district permits in ACE (Legacy Portal). District permit records are visible in ACE (Legacy Portal)in the Modernized Portal under the “Cancelled Permits” tab.

Customs Broker Modernization Regulations § 111.28 Responsible Supervision and Control Factor Considerations

Every individual broker operating as a sole proprietor, every licensed member of a partnership that is a broker, and every licensed officer of an association or corporation that is a broker, must exercise responsible supervision and control (see § 111.28(a)) over the customs business transacted by the sole proprietorship, partnership, association, or corporation. A sole proprietorship, partnership, association, or corporation must employ a sufficient number of licensed brokers relative to job complexity, similarity of subordinate tasks, physical proximity of subordinates, abilities and skills of employees, and abilities and skills of the managers, among other relevant considerations.

While the determination of what is necessary to perform and maintain responsible supervision and control will vary depending upon particular circumstances, each broker needs to evaluate his or her own business to identify how to provide high quality service to their clients. However, there are certain factors which CBP may consider in its discretion and to the extent any are relevant, which include but are not limited to the following:

- The training provided to broker employees;

- The issuance of instructions and guidelines to broker employees;

- The volume and type of business of the broker;

- The reject rate for the various customs transactions relative to overall volume;

- The level of access a broker’s employees have to current editions of CBP regulations, the Harmonized Tariff Schedule of the United States, and CBP issuances;

- The availability of a sufficient number of individually licensed brokers for necessary consultation with employees of the broker;

- The frequency of supervisory visits of an individually licensed broker to another office of the broker that does not have an individually licensed broker;

- The frequency of audits and reviews performed by an individually licensed broker of the customs transactions handled by their employees;

- The extent to which the individually licensed broker who qualifies the permit is involved in the operation of the brokerage and communicates with CBP;

- Any circumstances which indicate that an individually licensed broker has a real interest in the operations of a broker;

- The timeliness of processing entries and payment of duty, tax, or other debt or obligation owing to the Government for which the broker is responsible, or for which the broker has received payment from a client;

- Communications between CBP and the broker, and the broker’s responsiveness and action to communications, direction, and notices from CBP; and

- Communications between the broker and its officer(s) or member(s); and the broker’s responsiveness and action to communications and direction from its officer(s) or member(s).

To demonstrate some of the particular circumstances that may be relevant to the above factors and may be considered by CBP, we provide examples below. Each example is merely illustrative in nature as to some of the possible circumstances and considerations relevant to certain factors. We stress that each determination is fact-specific and varies depending upon the particular circumstances surrounding the customs business being conducted.

For factor one, examples include whether a broker

- provides a developed training program and/or materials for new employees;

- provides access to CBP webinars specific to the employee’s job;

- provides a mentoring program within the brokerage; and updated training and materials to reflect operational changes.

For factor two, examples include whether

- a broker maintains an internal handbook or manual;

- the resources provided to employees account for recent changes to CBP regulations.

For factor three, examples include

- the number of commodities a broker handles;

- the number of clients a broker manages;

- the complexity of the entry transactions;

- the number of entries filed annually

For factor four, examples include whether a broker

- reviews transactions for completeness/correctness prior to submission to CBP;

- addresses rejected transactions to ensure that future transactions of a similar nature do not result in the same reject.

For factor five, examples include whether a broker

- provides current electronic resources accessible on the employee’s computer and/or sufficient current paper resources to be shared by employees within the office;

- maintains CBP issued guidance such as CSMS messages and port issued Trade Notices.

For factor six, examples include whether a broker

- employs enough individually licensed brokers (ILB) to provide broker employees with timely attention (e.g. assistance, guidance, consultation) in the course of customs business;

- considers the ratio of employees to ILB (e.g. a larger brokerage may need more licensed brokers than a smaller brokerage for oversight);

- considers the amount of varied and complex customs business that may need more experienced ILBs to provide guidance to broker employees;

- considers the amount of broker locations and ease of employees’ ability to obtain advice, concurrence, and vetting from an ILB who is on site or readily available by email, messaging or phone.

For factor seven, examples include whether a broker

- maintains an office visit schedule based on identified business needs of the offices without an ILB;

- documents visits to offices without an ILB.

For factor eight, examples include whether an ILB

- maintains an audit and review schedule of the employees’ work;

- documents when audits and reviews are performed.

For factor nine, examples include whether the qualifying ILB

- maintains oversight responsibility over some or all of the customs business conducted;

- conducts periodic reviews of the customs business conducted to determine whether any new guidance, operational changes, etc. are needed;

- independently handles or reviews certain high-risk customs business transactions;

- audits entry rejects and other entry communications from CBP and other government agencies to ensure timely and appropriate responses were provided.

For factor ten, examples include whether an ILB

- conducts periodic reviews of all customs business transacted by the employees he/she manages;

- pursues continuing education opportunities specific to the industry focus of the brokerage.

For factor eleven, examples include whether a broker

- maintains an accounting system to ensure duty payments provided by the importer to the broker are submitted in a timely fashion to CBP and duty payments provided by the importer that are not owed to CBP are reported to the importer;

- has a procedure to file an entry and notify CBP when an importer has failed to provide duty payment.

For factor twelve, examples include whether a broker

- maintains evidence of timely responses to CBP inquiries and notices;

- maintains evidence that the broker takes appropriate action when provided direction from CBP.

For factor thirteen, examples include whether a broker

- maintains evidence that problems with a customs transaction or employee’s conduct are immediately reported to officers/members, and promptly resolved;

- maintains evidence that the broker is keeping its officers/members informed of the volume of operations so officers/members can assess whether additional ILBs are needed;

- maintains evidence reflecting that the broker is responding to communication and following direction from the officers/members

- 87 FR 63267 - Modernization of the Customs Broker Regulations (Final Rule)

- 87 FR 63262 - Elimination of Customs Broker District Permit Fee (Final Rule)

- Fact Sheet - Key Changes Modernizing Customs Broker Regulations 19 CFR 111

- Fact Sheet - Responsible Supervision and Control

- Fact Sheet - Separation from a Client

- Fact Sheet - Broker Permit Reporting Capabilities in Modernized ACE

- 19 CFR 111 Side-by-Side Comparison Chart

- Customs Broker Guidance for the Trade Community

- Power of Attorney Job Aid

- Triennial Report Job Aid

- Sample National Permit Application

- Customs Broker Licensing Process

- Customs Broker License Exam Job Aid

Webinar (December 1, 2022 at 1:00 p.m. ET)

CBP hosted a webinar December 1, 2022 at 1:00 p.m., ET. This educational webinar covered Frequently Asked Questions related to 19 CFR 111. Play December 1, 2022 Webinar Recording or December 1, 2022 Webinar Slides .

Webinar (November 9, 2022 at 3:00 p.m. ET)

CBP hosted a webinar November 9, 2022 at 3:00 p.m., ET. This educational webinar covered operationalizing changes to 19 CFR 111. Play November 9, 2022 Webinar Recording or November 9, 2022 Webinar Slides.

Webinar (October 27, 2022 at 1:00 p.m. ET)

CBP hosted a webinar October 27, 2022 at 1:00 p.m., ET. This educational webinar covered detailed changes to 19 CFR 111. Play October 27, 2022 Webinar Recording or October 27, 2022 Webinar Slides.

Webinar (June 17, 2022 at 2:00 p.m. ET)

CBP hosted a webinar June 17, 2022 at 2:00 p.m., ET. This educational webinar covered Notice of Proposed Rule Making (NPRM) recommendations to the broker regulations in 19 CFR 111, to include national broker permits. Play June 17, 2022 Webinar Recording.

Cargo Systems Messaging Service (CSMS)

CSMS is one of CBP's methods for communicating with our trade partners on news and updates on our automated systems - namely the Automated Commercial Environment (ACE).

CSMS# 55888809 - UPDATE: Modernized ACE Portal Broker Employee Reporting Requirements to be Satisfied by 4/14/2023

CSMS# 55845210 - REMINDER: Modernized ACE Portal Broker Employee Reporting Requirements to be Satisfied by 4/14/2023

CSMS# 55152029 - REMINDER: February 24, 2023 Annual User Fee Due Date

CSMS# 55089076 - REMINDER: Requirement for Powers of Attorney (POAs) Executed Prior to 12/19/2022 to be Satisfied by 2/17/2023

CSMS# 54964247 - Extension for Modernized ACE Portal Broker Employee Reporting Requirements to be Satisfied by 4/14/2023

CSMS# 54657364 – Add/Upload Employee Feature for Broker Reporting Now Available in Modernized ACE Portal

CSMS# 54525793 – Updated Customs Broker Guidance for the Trade Community (Version 1.1)

CSMS# 54416648 – Broker Modernization in ACE Training Materials Available on cbp.gov

CSMS# 54411984 – Today is the Final Rule Effective Date: Modernized Customs Broker Regulations 19 CFR 111

CSMS# 54387706 – Delay in ACE Employee Upload Feature in Modernized Portal

CSMS# 54387492 – February 24, 2023 Annual User Fee Federal Register Notice Due

CSMS# 54387351 – REMINDER: December 19, 2022 is the Final Rule Effective Date for the Modernized Customs Broker Regulations 19 CFR 111

CSMS# 57280019 – Guidance for Brokers Transitioned to a National Permit

CSMS# 54349948 – Modernized Customs Broker Regulations: ACE Broker Account Permit Transition Activities

CSMS# 54194146 – Requirement for Powers of Attorney (POAs) Executed Prior to 12/19/2022 to be Satisfied by 2/17/2023

CSMS# 53677806 – National Broker Permit Functionality Deployed to CERT

CSMS# 53677669 – Draft Version of the Batch and Block CATAIR Posted to CBP.gov

CSMS# 53676905 – CBP's Updated Customs Broker Guidance is Now Available

CSMS# 53677068 – 111 Final Rule Broker Regulations Webinars

CSMS# 52145776 – Modernization of Broker Regulations 111 Webinar

CSMS# 53697245 – Changes to 19 CFR 111 National Permit Transition Process