Important

The requirement to obtain continuing education is not yet in place.

You are not required to obtain any education credits at this time.

The education accreditors have not yet been selected.

Accreditors and the number of credits you will need by 2027 will be announced in the Federal Register, on this website, and in a CSMS message.

You will only receive Continuing Education credits for activities you participate in AFTER the Federal Register Notice has been published. No activity counts for continuing education at this time.

What CBP is doing in the coming months to prepare for the Continuing Education rollout:

- Selecting accreditors to review content and activities that could be eligible for Continuing Education credit.

- Working with the accreditors to put the processes and policies in place for a successful Continuing Education accreditation process.

- Working with Partner Government Agencies (PGAs) to identify their activities that would be eligible for Continuing Education.

- Identifying existing CBP webinars that would be eligible for Continuing Education credit.

What individually licensed brokers can do to prepare for the Continuing Education requirement:

- Bookmark this webpage and check in periodically for updates and announcements.

- Sign up for CSMS messages (Cargo Systems Messaging Service). All important updates for Continuing Education will be broadcast through CSMS messages.

- Read the Final Rule: Federal Register : Continuing Education for Licensed Customs Brokers.

Background: Continuing Education for Licensed Customs Brokers Final Rule

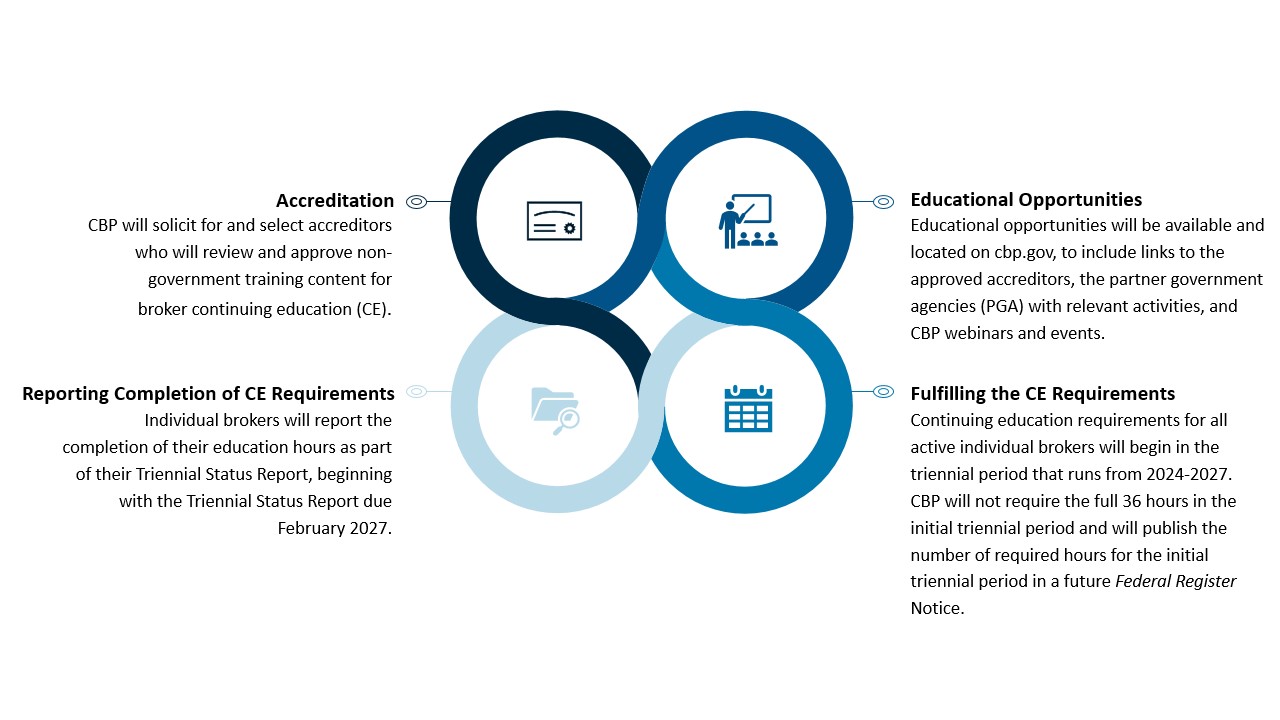

U.S. Customs and Border Protection (CBP) published the Continuing Education for Licensed Customs Brokers Final Rule (88 FR 41224), which amends CBP regulations to require continuing education for individual customs broker license holders (individual brokers) and creates a framework for administering this requirement.

The Final Rule requires that that brokers must complete 36 continuing education credit hours per triennial status period. During the current triennial period (2024-2027), CBP will allow brokers to complete fewer than 36 hours, since you do not have the full three years to complete the continuing education. Further guidance on how many continuing education credits will be required for the 2024-2027 triennial status period will be published on CBP.gov and in a Federal Register notice.

CBP and U.S. partner government agencies (PGAs) will offer a variety of continuing education credits at no cost to customs brokers. Training and educational opportunities offered by a third-party outside of CBP or PGAs will require approval by a CBP-selected accreditor. Information on the accreditation process and details on courses offered by CBP and PGAs will be posted on this page as they become available.

Continuing Education at a Glance

Additional Resources

Question: I own a brokerage with a corporate license, and I am the individual license holder. I am the only license holder in my company as well. Would I have to complete the new continuing education requirements for my individual license only, or would I not need to complete any at all?

Answer: As the individual license holder, you will be responsible for completing the continuing education requirement each triennial period.

Question: My association is having a Lunch-and-Learn for our local brokers. I submitted my activity to an accreditor, and it was approved for 1 hour of continuing education. A guest speaker will come talk to us about how to submit an allegation of dumping under EAPA. At the last minute, my speaker had to cancel. A new speaker can take her place, but the new speaker will be presenting on importation and how to identify and report potential fentanyl smuggling. Can the attendees still get credit for coming to my association’s activity?

Answer: This is one of the scenarios that CBP and the accreditors will need to consider as we develop and roll out the Continuing Education program. CBP and the accreditors will need to put forth guidance on submitting activities that will take place only one time in a year (like a conference or a single recorded webinar,) versus activities that would be considered a series of events (like a monthly lunch-and-learn or periodic webinar), versus a single presentation that will be given multiple times (like a training roadshow or in-person training that will have multiple sessions). This guidance should be easy to find and follow on each accreditor’s website.

Question: If I send my training to an accreditor, can I use it internally with my Brokerage Team for my continuing education credits?

Answer: Yes, with some limitations. You may only claim one credit hour for preparing the training, regardless of how long you actually spent in preparation or how long the training actually is. Per triennial period, you may claim a combined total of 12 credit hours spent preparing training materials. This is contained in §111.103(b). CBP created this limitation because we want individual brokers to also seek out education opportunities, not just conduct training. We recognize that preparing training does have a benefit, particularly if it is internal company training where compliance is an important factor in operations. As an instructor, you can get some continuing education credits, but you cannot have instruction constitute all 36 credits in one triennial period.

Question: I am an active broker, and I am about to leave my company to work for another company where I will also be an active broker. Is my current employer required to report my continuing education credits I’ve earned this triennial period to my new employer?

Answer: No. Earning credits, recordation of your credits, and maintaining documentation of your credits earned is your responsibility as an individual licensed broker. If employers maintain a system for their brokers to record and maintain their credits, that is fine, but when an employee leaves one company to work at another, it is not the responsibility of the old employer to communicate with the new employer on continuing education credits.

Question: I don’t file my TSR or complete my continuing education. Will CBP suspend my license?

Answer: Yes. Under § 111.30(d)(4), if a broker fails to file the TSR by March 1 of the reporting year, the broker's license is suspended by operation of law on that date. By March 31 of the same reporting year, CBP will transmit written notice of the suspension to the broker by certified mail, return receipt requested, at the address reflected in CBP records. If the broker files the required report and pays the required fee within 60 calendar days of the date of the notice of suspension, the license will be reinstated. If the broker does not file the required report and pay the required fee within that 60-day period, the broker's license is revoked by operation of law without prejudice to the filing of an application for a new license. Notice of the revocation will be published in the Federal Register.

The new continuing education requirement follows the same timeframe as the TSR, for convenience of reporting and tracking, but it is not directly tied to the TSR. If you fail to file your TSR, then CBP follows the procedure above contained in § 111.30(d)(4). If you take corrective action within the 60-day period, then your license is no longer suspended. If you fail to complete and certify your continuing education credits, then you follow the procedures outlined in § 111.104. You will receive notice of failure to report (§ 111.104(a)). You will then have 30 days to respond to CBP with a corrective action (§ 111.104(b)). If you fail to take action, your license will then be suspended (§ 111.104(c)). You will then have 120 days from the suspension date to take the corrective action to complete and certify your continuing education (§ 111.104(d)); otherwise, your license will be revoked and you’ll need to apply for a new license.

Question: Is there an email list or newsletter that brokers can sign up for to be kept aware of training and educational opportunities?

Answer: CBP plans on using this website to keep brokers up-to-date on CBP offerings, PGA offerings, and links to the accreditors' websites for their lists of approved activities. Bookmark this page and please visit often!

Question: Will the ACE Biweekly meetings count toward the continuing education requirement to complete at least 36 continuing education credits per triennial period?

Answer: No, they will not.

Question: Can anyone in our company, including our owners and officers, participate in continuing education for credit or is it only for our in-house brokers?

Answer: The continuing education requirement is mandatory for individual licensed customs brokers. The requirement does not apply to the corporate or organizational license. If you are the qualifier for the corporate or organizational license, then you hold an individual license, and the continuing education requirement applies to you.

If non-licensed employees would like to take part in the same continuing education activities as license holders, there is no CBP-mandated restriction in participating. Since only individual licensed brokers have a continuing education requirement, only these participants would receive continuing education credit. For example, a company may hold a training session that covers customs business, but all employees working in customs activities, whether they hold a license or not, would benefit from taking the training. As another example, multiple employees could all benefit from participating in a CBP webinar on classifying a certain commodity. Unless accredited private-sector activities have an explicit restriction on who can participate, attendance is open to all; but only the individual license holders will need or want to count it as continuing education credit, since they are the one with the requirement.

Question: I just passed the Customs Brokers License Exam and in the near future will be submitting my application to become a broker. Will the continuing education requirement be applicable to me?

Answer: Yes, but only after the 2027 Triennial Reporting cycle is complete. You will need to obtain, record, and report the continuing education credits you receive from 2027 to 2030 in your 2030 Triennial Status Report.

Per 19 CFR 111.102, individual license holders do not need to complete continuing education when they have not held their license for an entire triennial period at the time of the status report. If you receive your individual license between now and 2027, you will not need to obtain any continuing education credits. However, even though credits are not required, CBP encourages new brokers to take full advantage of the many opportunities available online and in-person to enhance their professional credentials in the field of customs business. New brokers should also adhere to their company’s training policies, if applicable.

Question: I own a brokerage with a corporate license, and I am the individual license holder. CBP says that corporate license holders do not have a continuing education requirement. Is this correct?

Answer:Yes, the new continuing education requirements apply only to individual license holders. Corporate, or organizational, licenses do not have a continuing education requirement under 19 CFR Part 111 Subpart F. Education at the corporate level is already one of the factors that is considered under Responsible Supervision and Control under 19 CFR 111.28(a)(1). This employee training has been a factor considered under Responsible Supervision and Control for several decades.

Question: How is an accreditor selected?

Answer: Accreditors will be selected by CBP via the RFP process and the list of selected accreditors will be published in a Federal Register Notice.

Question: Will training taken in January 2027 count toward the 2027 triennial submission? Can that same training be counted again in the 2030 triennial submission?

Answer: CBP will provide additional guidance on this upcoming situation as the date draws closer.

Once you have submitted your triennial status report in eCBP, any course you take after that will count toward the credit for the next triennial period.

Please note: for the 2027 triennial period, only those activities that have occurred after the Federal Register Notice has published with the number of credit hours required will be considered eligible for credit.

No activity will receive credit in two different triennial periods.

Question: We are interested in becoming a partner with CBP to administer continuing education courses for licensed customs brokers as an accredited partner. Will CBP partner with licensed customs brokers to host trainings, seminars, and classes?

Answer: CBP does not have the resources to partner with all the organizations, companies, and associations that are interested in providing continuing education activities. Therefore, CBP is selecting a number of entities to provide accreditation for brokers interested in hosting activities that would qualify for continuing education credit. CBP is not entering into partnering arrangements with content developers or providers, only the accreditors.

Question: I am going to retire in February 2027 to coincide with the triennial period. I do not plan to keep my license active after this point. Do I need to comply with the new requirements?

Answer: Yes. As long as your license is in an active status, you will be required to meet the continuing education requirement. This is because it important to keep your knowledge bank fresh during the time that you are transacting customs business. Additionally, plans change, and if you decide you’re not going to retire in 2027 after all, and it is already close to the reporting deadline, you may have difficulty completing all the required hours. If you do not intend to file a triennial report or pay your fee, you should still submit the information that you completed the continuing education. CBP is intending to modify eCBP.gov to capture a scenario such as this one.

Question: I offer training for customs brokers. How do I get my course offerings accredited?

Answer: CBP does not know the exact process for submitting course offering for consideration because the accreditors have not yet been selected. CBP will work with the accreditors as the program is stood up to ensure that instructions for educators and individual licensed brokers are clear and user-friendly. CBP is also going to require that accreditors be able to accept course offerings electronically, which should help facilitate educators’ submissions for consideration.

Question: Can you tell me how to find continuing education courses so that I can get my broker’s license?

Answer: The continuing education requirement will be for individuals who already have a customs broker license. The new requirement does not apply to anyone who is not already a license holder. In order to obtain a license, you can get more information at this CBP website which explains what a customs broker is and how you become one. In general

- You must pass the Customs Broker License Examination.

- You must submit a broker license application with appropriate fees.

- Your application must be approved by CBP.

Question: Will an EU Masters of Customs, Taxation and International Trade Law (MCA) program or other EU customs classes be applicable for credits?

Answer: Courses provided by non-U.S. government agencies will not be approved as continuing education credit. The U.S. individual broker license is based on knowledge of U.S. laws, regulations, and systems. U.S.-based accreditors will not be able to assess the value of programs and courses that do not pertain to U.S. laws and regulations. While CBP does not want to discourage any broker from taking courses and training that are of value, CBP cannot approve non-U.S.-based activities.

Question: Would trade compliance conferences like ICPA be considered for the accreditation?

Answer: CBP cannot say what will be approved or not because CBP is not an accreditor. Once the accreditors have been identified and the approval process for getting activities is in place, associations that hold conferences, such as the International Compliance Professionals Association, should submit their draft agendas to one of the accreditors for full consideration. In general, CBP finds conferences and symposia to be valuable educational and networking opportunities for all trade professionals, whether public or private sector.

Question: Is continuing education required for an inactive license?

Answer: Yes. Unless your license is in voluntary suspension, you will be required to complete the 36 hours of continuing education every three years and report that with your triennial report.

Question: What would be required to suspend a license if an individual is not conducting customs business and chooses not to be subject to the CE requirements?

Answer: Per § 111.52, the Office of Trade Broker Management Branch may accept a broker’s written voluntary offer of suspension of the broker’s license or permit for a specific period of time under any terms and conditions to which the parties may agree.

Question: Will there be opportunities to add additional accreditors if an accreditor is not selected in the initial process?

Answer: CBP has determined that the initial term of being an approved accreditor will be three years. If a party is not selected in the first selection cycle, they can respond to future Requests for Proposals for consideration. CBP has determined three years is an appropriate period of time and allows CBP to ensure that the accreditor selection process does not interfere with the close of a triennial period. CBP may adjust the term in future Requests for Proposals as circumstances and hindsight dictate the best practice.

Question: Will I have to send proof of credit to accreditors or just keep it for CBP/Broker Management Branch auditing purposes?

Answer: You will not have to provide anything to an approved accreditor proving that you completed any educational offering. You must retain the following information and documentation for your continuing education credits:

- The title of the qualifying continuing education attended.

- The date(s) attended.

- The location of the qualifying continuing education (“online” if the activity is web-based).

- Any documentation received from the provider or host of the activity that proves you attended and completed the activity.

(See § 111.102(d)(1))

Note that CBP is not requiring any specific format for this information. A simple spreadsheet or electronic table with accompanying certificates or receipts (paper or electronic) would be considered acceptable, so long as it can be provided to CBP upon request (See § 111.102(d)(2)).

Question: I am a licensed customs broker working for a private company. I cannot obtain credits with the NCBFAA because I am not allowed to join since I don’t work for a broker or forwarder.

Answer: Anyone can participate in courses offered by NCBFAA’s Education Institute (NEI). The course and exam fees do differ between NCBFAA member and non-members. For more information, you can visit the NCBFAA Website.

You do not have to obtain continuing education credits from any specific organization. The course only needs to be accredited (if offered by the private sector) or offered by CBP or other government agency.

Question: If a broker earns credit for information that becomes obsolete, will the earned credit still be acceptable?

Answer: Any accredited continuing education credit or government-hosted activity designated as good for continuing education that is taken during the triennial period will count, no matter at what point during the period that the credit was earned. CBP notes that the accreditation period for any training of educational activity is 1 year. If the trainer or education provider would like the activity to be valid for longer than 1 year, then they will need to resubmit their materials to one of the approved creditors for consideration and reaccreditation. However, if you took the accredited training in the year it was approved, you do not need to take it again the next year unless you find the activity useful or of value to you. It is the responsibility of the education providers, through accreditation, to keep their materials fresh. It is your responsibility as a broker to obtain the education when it is offered and of value to you.

Question: Will a certain number of credits be required for a specific topic?

Answer: CBP is not requiring that a minimum or specified number of continuing education credits be on any specific topic. These regulations do not require individual brokers to fill the 36 continuing education credits with specific training or educational activities, such as ethics training. Individual brokers are encouraged to seek the training, educational activity, and topics that best suit their needs during each triennial period.

Question: Will training taken in January 2027 count toward the 2027 triennial submission? Can that same training be counted again in the 2030 triennial submission?

Answer: CBP will provide additional guidance on this upcoming situation as the date draws closer. Once you have submitted your triennial status report in eCBP, any course you take after that will count toward the credit for the next triennial period.

Please note: for the 2027 triennial period, only those activities that have occurred after the Federal Register Notice has published with the number of credit hours required will be considered eligible for credit.

No activity will receive credit in two different triennial periods.

Question: I am attending a trade-related conference this fall. Does this count toward my continuing education credit for the new requirements?

Answer: No.

Until CBP selects accreditors, CBP cannot say for certain whether conferences or other activities will qualify for continuing education credit. Additionally, CBP will not be making the determination of whether conferences held by the private sector will qualify for continuing education—that is the function of the accreditors.

The continuing education requirement is not yet fully in place. CBP will be soliciting for information, then release a Request for Proposals, then go through a selection process with parties who would like to become accreditors. Once CBP selects the accreditors, we will publish a Federal Register Notice announcing the accreditors. In that Federal Register Notice, CBP will announce how many credit hours will be required between that date and the end of December 2026 (when the triennial reporting period on eCBP.gov opens). Any activities conducted before that Federal Register Notice is published will not be considered eligible for continuing education credit because none of these activities will have been reviewed and approved by an accreditor.

While participating in activities prior to this Federal Register Notice will not count toward the continuing education requirement, CBP does not want to discourage any broker from attending conferences or training that provide value and knowledge to the individuals participating.

Question: What happens if I fall just short of completing the continuing education credit hours in the given triennial reporting period? If I don’t complete the continuing education credits 2027 and my license is suspended, how do I reinstate my license?

Answer: If you do fall short of credit hours, then your license is at risk of being suspended. Unless you take corrective action to make up the credit hours, then CBP will move to suspend your license (See § 111.104(b)(2)). You will be given notice that your license is about to be suspended, and you will then have 30 days to take corrective action (See § 111.104(c)). If you fail to take corrective action during this 30-day window, then your license will be suspended.

If an individual broker license is suspended, you can still take corrective action on or before 120 calendar days from the date of issuance of the order of suspension (See § 111.104(d)). Corrective action can range from certifying completion of the requirement to completing 36 continuing education credits.

In setting this 120-day window (approximately four months), CBP believes that we have provided sufficient time in the most extreme situation for a broker to complete all 36 hours of education and return to good standing. You as an individual broker should be aware that CBP is serious about compliance with the continuing broker education requirement. CBP also wants to ensure minor mistakes and life circumstances can be addressed and mitigated with a limited effect on your license.

Question: Will corporate trade compliance training qualify as continuing education?

Answer: Until CBP selects accreditors, CBP cannot say for certain that trade compliance training offered by a company employing customs brokers will meet the continuing education requirement. Once the continuing education requirement goes into effect and accreditors have been chosen, brokers who work for a corporation should collaborate with each other and the corporation’s management to submit their corporate training materials to one of the selected accreditors for consideration. The criteria for receiving approval and instructions for submitting materials for consideration will be provided by each accreditor as part of their public-facing website. In-house training is, presumably, intended to provide individuals within the company the most relevant information on that company’s processes and best practices, something that is vital to a business’s viability. CBP supports these activities and believes they should be considered by an accreditor for potential continuing education credit.

Question: I have retired but would like to keep up my license. Will I have to meet the continuing education requirement?

Answer: Yes. If you would like to keep your license active even if you are no longer working as a customs broker, you will need to obtain the continuing education credits (36 hours over 3 years) and continue to meet all reporting requirements and payment of applicable fees. Even brokers who are not actively engaged in transacting business as a broker might be leveraging their broker license in other ways—for example, as an employee of a company or as a consultant. A broker can become active at any point after a period of inactivity and then must meet the same levels of professionalism and knowledge as any other broker who has been actively engaged in transacting business. If you expect to not actively engage in transacting business as a broker for an extended period of time, you may want to consider having your license voluntarily suspended (see 19 CFR 111.52) and, thereby, not be subject to the broker continuing education requirement during the period of voluntary suspension.

Question: Will the Certified Customs Certification (CCS) and the Certified Export Specialist (CES) designations/certifications count toward the new continuing education requirement in Part 111?

Answer: Until CBP selects accreditors, CBP cannot say for certain whether the education requirement for a CCS or CES will meet the new continuing education requirement. CBP has not evaluated the specific training materials required to attain these certifications. As of now, there are no qualified trainings or educational activities because CBP has not identified nor have any CBP-selected accreditors approved any such activities. However, CBP envisions future accreditors will likely determine that trainings and activities designated for CCS and CES will qualify as continuing education under § 111.103, given the history of these certificate programs and their reputation in the broker community.

Question: Can an individual broker obtain all the required continuing education credits in one year or do they have to be spread over all three years?

Answer: The 36 continuing education credits can be completed at any time during the triennial period. The new regulations also do not require individual brokers to fill the 36 continuing education credits with specific trainings.

If a broker wants to attend a week-long trade conference sponsored by the U.S. Government, an association, or a private company, that will likely cover, or come close to, covering the 36 hours for that reporting period. If instead a broker wants to obtain their education in smaller units that does not involve travel, hotel stays or time away from their workplace, they could choose shorter, virtual options like webinars and online courses.

The purpose of the regulatory requirements as finalized is to encourage individual brokers to seek the trainings, educational activity, and topics that best suit their needs during each triennial period. During our August 3 webinar, CBP encouraged individual brokers to “take stock” of the activities they already do that would likely qualify for continuing education credit. CBP also wants to encourage brokers to continue to attend the trainings, conferences and webinars involving customs business that provide them knowledge and value.

Question: I am an individually licensed customs broker. What do I need to do for continuing education between now and December 2023 when the next triennial reporting period opens?

Answer: Individual Customs Brokers are not required to complete any continuing education for maintaining their individual customs broker license in the current triennial period (2021-2024). The continuing education requirement will begin in the 2024-2027 triennial period. CBP will announce the start date and the number of education credits that will be required during this period in a future Federal Register notice and on the CBP website.

CBP encourages all brokers to take this time before the requirement is in place to take stock of their education activities over the past several years. Individual brokers may start to identify those activities that could likely qualify for education credit once the new requirement is in place. Individual brokers will likely find that many education activities currently pursued will likely meet the continuing education requirements. Some examples to consider:

- Attended a meeting of your local broker association

- Participated in a commodity webinar hosted by CBP’s National Commodity Specialist Division

- Participated in a local Trade Day hosted by the CBP Port Director

- Took an online training course, such as those conducted by a trade association

- Attended a CBP Trade Facilitation and Cargo Security Summit

CBP encourages individual brokers to continue monitoring this website for updated information on the new Broker Continuing Education requirement.

Have a question? Please submit your questions to: ContinuingEducation@cbp.dhs.gov. CBP will continue answering questions that come to this box in future updates to this website.

Webinar (August 3, 2023 at 1:00 p.m. ET)

CBP hosted a webinar on August 3, 2023, which provided an overview of the new regulations for customs brokers, which mandates a continuing education requirement to maintain an individual license. The webinar presented an implementation overview as well as next steps for brokers to take to meet the upcoming program requirements.

Continuing Education: New Requirements for Licensed Customs Brokers | Homeland Security (dhs.gov)

Cargo Systems Messaging Service (CSMS)

- CSMS# 57625703 - Request for Information for Continuing Education Accreditors for Licensed Customs Brokers Issued in SAM

- CSMS# 56727800 - Final Rule Published: Continuing Education for Licensed Customs Brokers

- CSMS# 56927521 - Continuing Education for Licensed Customs Brokers Webinar- August 3, 2023

Press Release: CBP Introduces Customs Broker Education Requirements