Solar Eclipse

A view of one of five solar rooftop installations at Pearl Harbor-Hickam military base in Hawaii. Photo courtesy of SolarWorld

It all started with an anonymous tip from industry. A concerned member of the trade community suspected an importer of fraud and alerted U.S. Customs and Border Protection. An online report, known as an e-Allegation, was filed and funneled to CBP’s national targeting unit in Miami. From there, the suspected trade violation crisscrossed the country and was shared with the agency’s Los Angeles-based Center of Excellence and Expertise for Electronics, the trade processing and enforcement hub for electronic goods imported into the U.S.

The industry source believed that the importer wasn’t fully disclosing the contents of its solar panel shipments from China to avoid paying hefty antidumping duties, which had been added to the price of a specific type of solar cell to protect American manufacturing.

Alan Aprea, one of the trade enforcement branch chiefs at CBP’s Electronics Center of Excellence and Expertise, was familiar with the importer and its California-based operation. “It’s a company that we had our eye on. The allegation just reinforced our decision to move forward,” said Aprea. “When we receive allegations, we take them very seriously, and we look into them to make sure we vet those companies.”

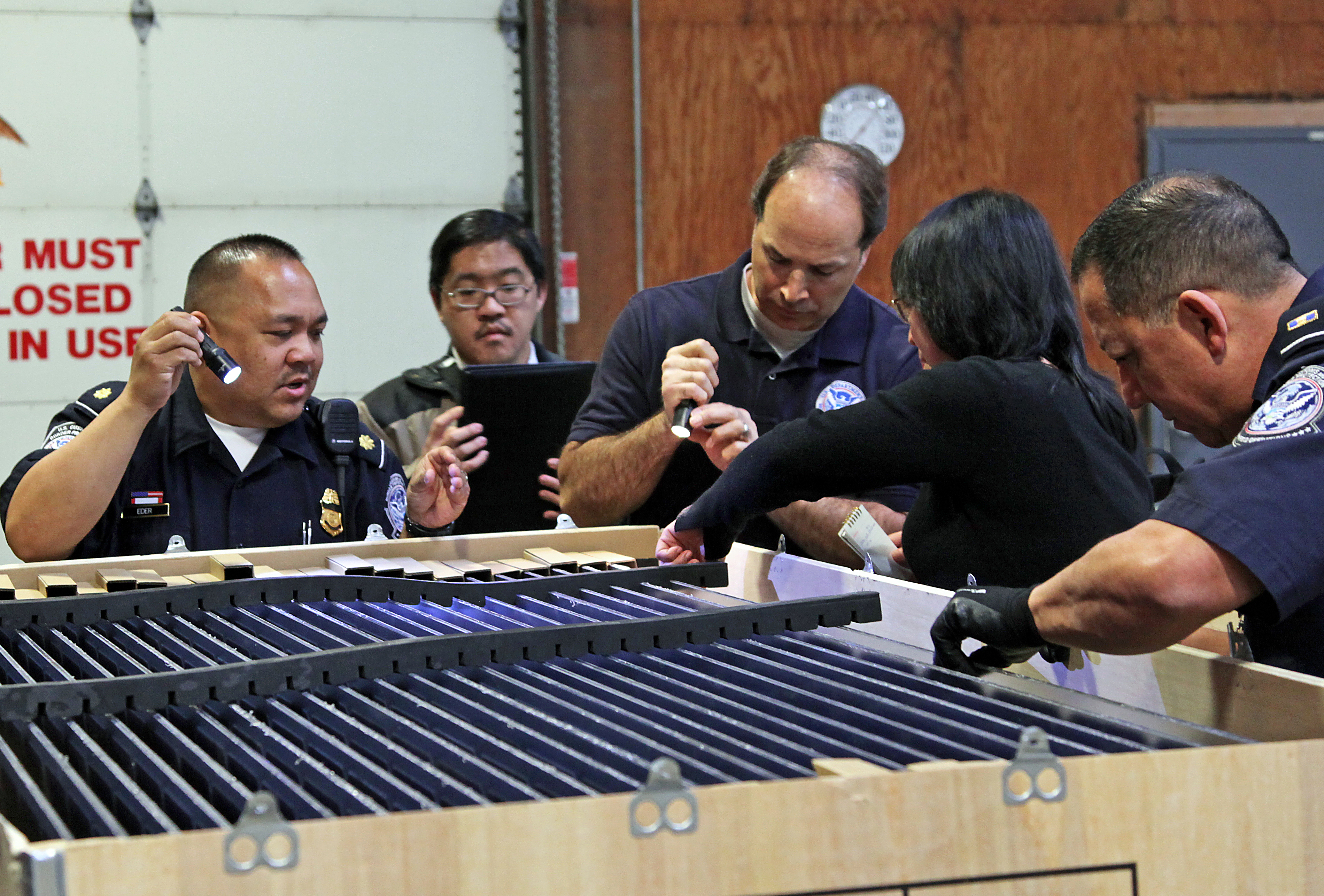

Aprea reached out to the port of San Francisco to target the importer’s incoming shipments. Five shipments were identified. Four were headed to the port of New York and one was routed to San Francisco. In March, when the San Francisco shipment arrived, a team of CBP officers, import specialists, and auditors collectively conducted a physical examination of the 36 crates containing the solar panels.

“When we open crates, we never know what we’re going to find. It’s not uncommon for goods to be misdescribed on the invoice,” said John Gerber, a CBP supervisory import specialist in San Francisco who is part of the electronics center’s enforcement team. The importer had listed the solar cells as "thin-film," a variety of solar cells that are duty-free. But the shipments were suspected to contain the protected type of solar cells made of crystalline silicon, which requires payment of duty.

Samples of the solar panels were sent to CBP’s San Francisco lab. There, scientists determined that the panels contained a mixture of both types of solar cells, matching the information that was received in the allegation. “We then expanded our investigation and looked at past importations from this importer to see if we could uncover additional violations,” said Aprea, noting that the electronics center found many.

“Our preliminary estimate shows that more than $50 million in duties, fees, and penalties will be owed to the U.S. government, and it all ties to this one importer and a tip from industry,” said Aprea. “CBP’s goal is to level the playing field—to make sure that everyone is operating in a fair manner when they’re conducting their trade business in the U.S.”

To bolster its efforts, CBP adopted a new enforcement strategy. Four years ago, when American solar panel makers were being driven out of business because of falling prices and stiff competition from China, the agency decided to take a proactive approach. CBP reached out to U.S. solar manufacturers to strengthen its enforcement techniques even before the U.S. Department of Commerce and U.S. International Trade Commission concluded that American businesses were suffering because of unfair foreign competition. It also was the first time that CBP took a holistic approach throughout the agency to prevent evasion of dumping orders, which require violating foreign companies to pay steep import duties to level the playing field for U.S. industry.

Chinese unfair trade practices

During the late 2000s, the climate for manufacturing solar panels in the U.S. was crumbling. “There was a concerted effort by Chinese manufacturers and the Chinese government to expand and take over solar manufacturing,” said Timothy Brightbill, an international trade attorney and partner at law firm Wiley Rein, who represents domestic companies and industries in trade remedy cases. “The government of China’s 5-year plan specifically called out renewable energy and solar as targeted areas for growth. We saw billions of dollars of subsidies given to Chinese companies. If you add up all of the grants, loans, and loan guarantees, it was more than $40 billion of subsidies,” he said. “At that time, 95 percent of China’s solar panels were being exported because China wasn’t using solar energy.”

As a result, there was a surge of solar panel imports coming into the U.S. from China. “Chinese imports peaked in 2011 at just under $3 billion worth of imports,” said Brightbill, who added that from “2009 to 2012, there was a 1,000 percent increase in imports of solar cells and panels from China into the U.S. That’s one of the largest surges of any product I’ve ever seen.”

The market flooded, causing a price collapse, which had a major impact on U.S. industry. “The price reduction was enormous. It was clearly a case where someone wanted to take the market share by dumping under cost. We were affected badly,” said Mukesh Dulani, the president of SolarWorld Americas Inc., in Hillsboro, Oregon, the oldest and largest crystalline silicon solar manufacturing firm in the U.S., which was founded in 1975 by an American entrepreneur, but now has German ownership.

“The company has gone through ups and downs because of the trade aggression from China,” said Dulani. “At the height of things, we had 1,335 people employed. Last year, we went down to 700. We had to shut down our California plant and lay off close to 200 people. We consolidated in Hillsboro, but then had to close two sections of our manufacturing here,” he said.

Before long, the entire U.S. solar manufacturing industry was experiencing shutdowns, layoffs and huge operating losses. “Company after company started closing and we made the decision to stand and fight,” said Dulani. In the fall of 2011, SolarWorld filed petitions with the U.S. Department of Commerce and the U.S. International Trade Commission, alleging that Chinese manufacturers were selling solar cells and panels at below market or “dumped” prices and were receiving unfair subsidies from the Chinese government.

From there, the Department of Commerce opened an investigation to determine whether the Chinese solar cells and panels were being dumped in the U.S. market or subsidized by the Chinese government. The U.S. International Trade Commission simultaneously began conducting its own investigation to determine whether or not U.S. industry was injured by the imported goods. In the event that unfair trade practices are found, the Department of Commerce decides the appropriate amount of antidumping and countervailing duties to remedy the market distortion caused by the dumping and subsidizing respectively. In other words, the additional taxes placed on the imported merchandise will level the playing field so that U.S. manufacturers can compete.

Proactive enforcement

Traditionally, CBP’s enforcement role begins when the investigations on a trade case are completed and the Department of Commerce issues a dumping order with instructions for CBP to follow. “From the time an initial claim is made until the Department of Commerce makes a final decision usually takes eight months to a year, so it can be quite a long time,” said Michael Walsh, CBP’s director of antidumping and countervailing duty policy and programs division in Washington, D.C. “We thought rather than wait all of that time for Commerce to make a decision, why aren’t we talking to industry now?”

So in the fall of 2011, when the petition was filed, CBP reached out to representatives of the solar industry. “We said, ‘Tell us about your product. How can CBP be smarter about enforcing the evasion of this order? What can we be doing even before the order goes into place?’” said Walsh. “This was the first time we ever did that with any industry. It was our first effort to be proactive in terms of the dumping process.”

According to Walsh, CBP changed its tactics because the agency wanted to be able to leverage the trade’s knowledge about its industry sector earlier. “Rather than having to start from ground zero when the order went into effect, we already wanted to be up and running and thinking about how do we best enforce this at the border,” he said. “In the solar panel case, we didn’t know if we needed special lab equipment or if there was some kind of country of origin test that we could do. Using this strategy, there were all kinds of questions that we were able to ask before the order went into place—not just from a laboratory standpoint, but from an officer, an import specialist and an auditor’s perspective too.”

Walsh explained that the agency’s new antidumping strategy, which is now being used for all industries, has embraced a holistic approach. “In the past, we were looking at antidumping in terms of stovepiping rather than at CBP as a whole,” said Walsh. “We realized that we were not being effective in our overall enforcement and that we needed to do a better job of coordinating our efforts. Now, we are thinking in terms of how we can best use all of the various parts and pieces of CBP. If we are trying to solve a problem, we figure out who the best players are and what is the best method that we can use,” he said. “Our overall goal is to protect the domestic economy and to make sure that folks who have been given the protection that dumping and countervailing orders are supposed to provide, get that relief. And that we are doing everything we can to protect jobs and enable U.S. industry to compete fairly on a level playing field.”

When the dumping orders were issued in December 2012, they specified that all merchandise containing crystalline silicon solar cells made in China were subject to duties. Most companies were required to pay about 30 percent extra on their shipments after the antidumping and countervailing subsidy duties were added on. But the rates could go much higher to approximately 250 percent for manufacturers that fall into a category where China’s countrywide rate is applied.

Learning from industry

By that point, CBP’s staff at the ports had been rigorously learning from industry for more than a year. “SolarWorld came out and conducted training. They talked to us about the technology involved in manufacturing solar cells and they brought examples that they shared with us,” said Aprea at CBP’s Electronics Center of Excellence and Expertise. “They were able to dive into the complexities of the scope of the order—what is considered in and out of the scope, what is acceptable and what isn’t.”

SolarWorld also held webinars and video teleconferences where CBP employees from across the country could call in and ask questions. “It was the first time that we brought someone in from the trade community to do that,” said Alexander Amdur, the branch chief of CBP’s antidumping and countervailing duty policy division.

Then the company hosted a tour of its Hillsboro factory for a group of CBP commodity experts, so they could see SolarWorld’s manufacturing process firsthand. “We saw how solar cells are made and which kind of solar cell falls under the dumping case. We also learned which countries have the capability to make crystalline silicon solar cells and which countries don’t, so that we could focus our attention better on which products would be suspect,” said Katie Schultz, a senior import specialist at the port of Portland in Oregon.

Schultz also learned that each solar cell has an ID number. “When the solar cell is placed into a panel, those solar cell numbers are identified as going into that panel, which is very important, because that is the industry norm,” said Schultz. “So when I get information from an importer who says, ‘There are 10,000 solar cells that went into the panels in that shipment,’ I can say, ‘Show me which cells went into those panels.’ This is the kind of information that I am using when I conduct my examinations.”

Scientific challenge

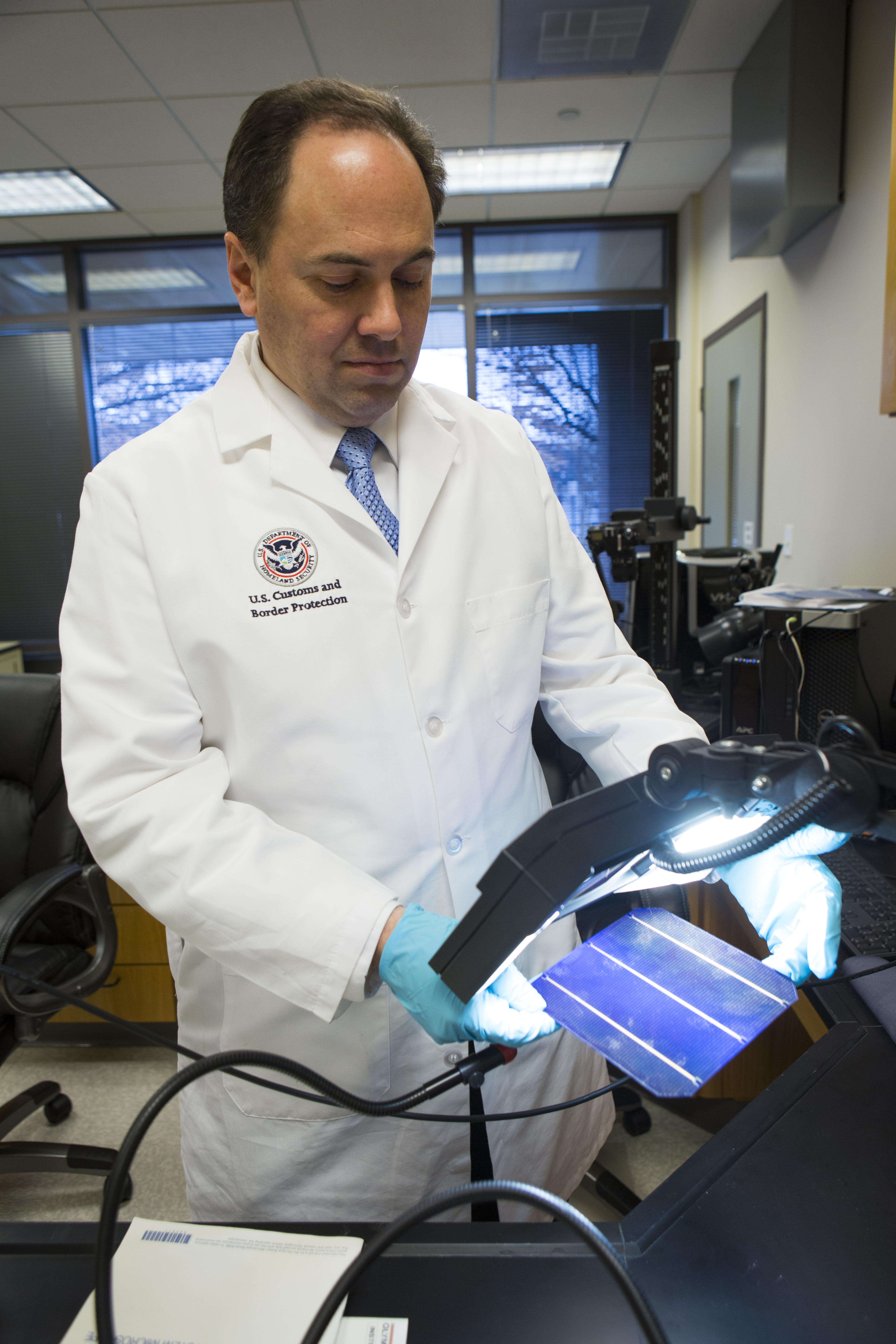

But the complexity of the commodity was only a part of CBP’s enforcement challenge. It also is difficult to determine where solar cells are made. “To date, there is no scientific technique to differentiate between different manufacturers or different countries that produce crystalline silicon solar cells,” said Steve Cassata, a CBP senior science officer based in Washington, D.C. “Crystalline silicon solar cells, which are almost pure silicon, are all manufactured with the same chemical composition, using the same methodology and the same manufacturing process, so this creates a challenge for our officers and the labs.”

However, the CBP labs do have some methods to test solar cells. “We can determine different types of solar cells, crystalline silicon versus thin-film varieties, based on thickness and the chemical composition of the cells,” said Cassata. The solar cells subject to the dumping order need to be made of crystalline silicon and be 20 micrometers or thicker. “Twenty micrometers is slightly thicker than a fine strand of human hair,” said Cassata. Additionally, the surface area of the solar cell needs to be larger than 10,000 square millimeters, roughly the surface area of one side of a DVD disk.

In contrast, the thin-film solar cells, which do not fall under the scope of the order, “are basically a chemical that’s sprayed onto a panel of glass and dried,” said Cassata. “On a microscopic level, it is much thinner than the crystalline silicon solar cells, so we are able to tell the difference.”

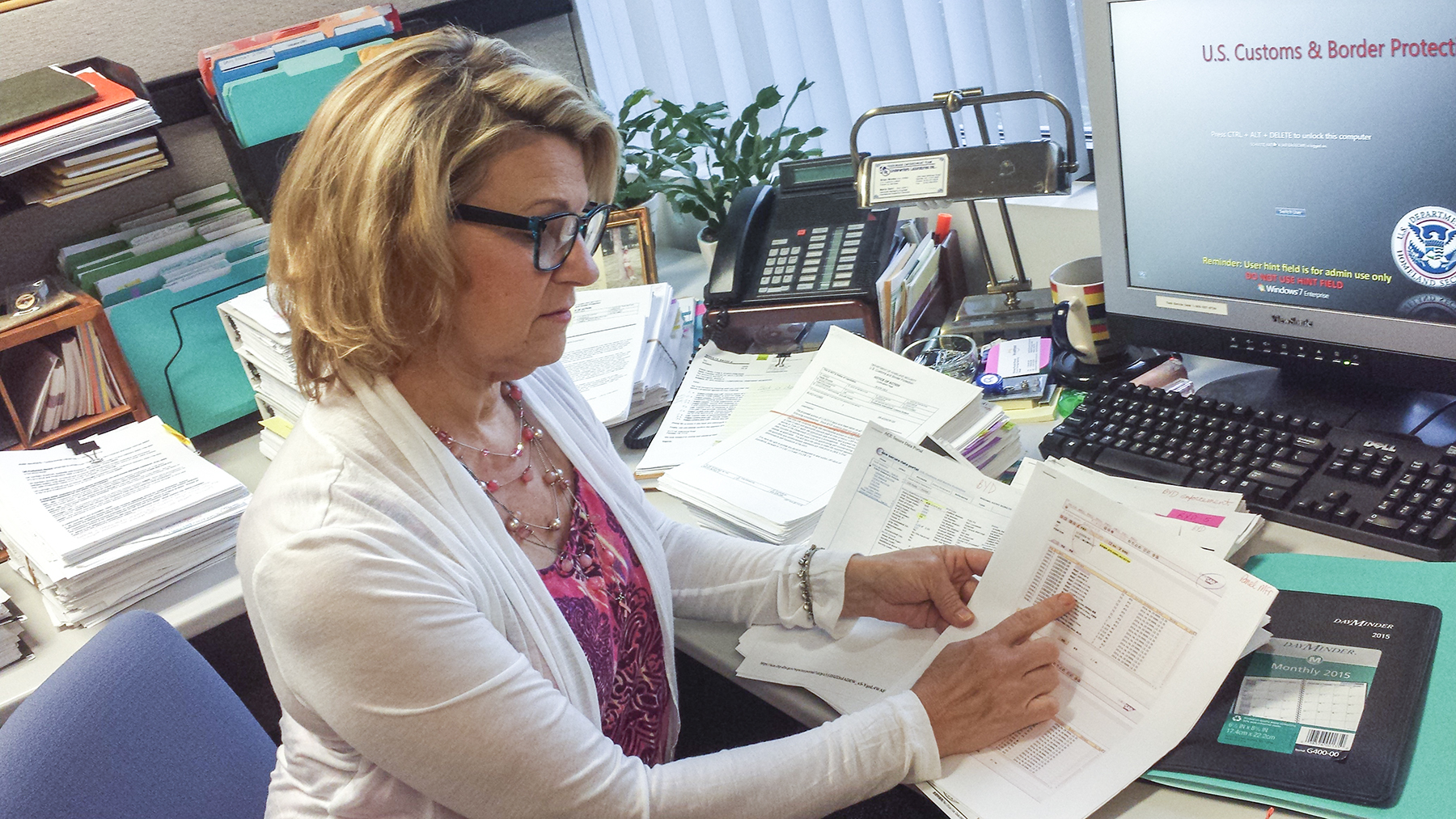

Rather than rely solely on lab results, CBP tackled the problem holistically and used other methods to determine where imported solar cells are made and to catch companies trying to evade paying the dumping duties. One technique that is used is tracing the paper trail to get to the source. “At the ports, the CBP officers are doing real-time examinations, but we’re able to review records, financial documents and import documents going back three to five years,” said Alexander Ebarle, the assistant field director of CBP’s Regulatory Audit Office in San Jose, California. “As auditors, we’re looking at the money and the money trail.”

Money trail

For example, when Ebarle’s auditing team couldn’t obtain sufficient information from an importer about the country of origin for shipments containing solar cells, they analyzed the manufacturer’s purchasing records in China. The manufacturer, a large solar cell producer based in Eastern China, claimed that the solar cells used in the panels were from Taiwan, so they didn’t need to pay any duties. Only solar cells made in China were dutiable. But when Ebarle’s team pieced together a timeline of when the solar cells were exported from Taiwan to China and when the panels were shipped to the U.S., it didn’t make sense.

“The purchasing records showed that the manufacturer’s earliest purchases of solar cells from Taiwan were made in April 2012,” said Ebarle. “But the shipments in question arrived in the U.S. a month earlier, in March 2012. Based on the records, we determined that they didn’t even have the solar cells at the time of importation,” he said. “When we showed the manufacturer the discrepancy, the company admitted right away that some of their shipments were made with Chinese solar cells.”

Ultimately, because of the manufacturer’s poor record keeping, Ebarle’s team determined that the shipments were partially dutiable and the company owed more than $10 million to the U.S. government.

In some instances, CBP’s auditors have been able to collect the revenue. This was the case when Ebarle’s team looked into the records of another solar panel importer and its Chinese parent company. The importer had been claiming that its shipments of solar panels were made exclusively with duty-free Taiwanese solar cells, but they couldn’t prove it. So in February 2013, Ebarle’s auditing team requested detailed purchasing, inventory, production and sales records from the manufacturer in Changzhou, China. “When they pulled their records, they couldn’t identify which types of solar cells were in the panels,” said Ebarle.

Two months later, the importer filed a disclosure for unpaid countervailing duties due to subsidies the manufacturer received from the Chinese government. “The disclosure was prompted by our request for detailed records from the Chinese manufacturer,” said Ebarle. As a result, in May 2014, CBP collected $829,000.

To help speed up the auditing process, CBP regulatory auditors have recently started using a survey technique where more than one company is targeted at a time. “We use surveys to quickly assess risk related to certain importers,” said Ebarle. “In that way, we are able to focus our resources on companies that represent the greatest risk and could be most damaging to the U.S. economy.”

At the port level, antidumping enforcement activities are coordinated through the Electronics Center of Excellence and Expertise. “We have a nationwide view of all of the importations that come into the U.S. and we’re conducting nationwide enforcement for electronics. Solar cells are one of the commodities,” said Aprea.

For uniformity at the ports, the electronics center sent out guidance to assist with solar panel cargo examinations. “We knew this was going to impact a lot of ports, so we put out guidance that is clear and concise for the field,” said Aprea. “It’s basically a well-defined list of questions so that we didn’t have one port asking different questions than another. It gives them a clear path of what the agency wants to look at and what kind of information we need for this particular product, so that we can do the best job of enforcement and protect American industry.”

Operation Solar Flare

Sting operations are one of the tactics CBP uses at the ports to enforce solar cell and panel dumping orders. Although many operations are conducted nationwide, one of the first and most successful is Operation Solar Flare at the port of Charlotte in North Carolina. The original operation ran from August to October 2012, and it’s still ongoing.

“Back in 2012, we were looking for a new enforcement operation. Our team focuses a lot on electronic products and we saw that a new dumping order was coming out on this burgeoning, new technology,” said Laurie Pazzo, a CBP senior import specialist at the port of Charlotte. “We thought what better time than now. Let’s get in on the ground floor and see what enforcement issues we can uncover.”

Pazzo and her teammates realized they didn’t know much about solar cells and panels, so they decided to educate themselves. They read articles, worked with CBP’s national import specialist who interprets the scope of dumping orders, and communicated with the Electronics Center of Excellence and Expertise. They also participated in the SolarWorld webinars and talked to others in the industry. “We reached out to the local industry in this region to learn about solar panels in terms of classification, manufacturing and differentiating the types of solar cells,” said CBP Import Specialist Jeff Sorrells. “We learned that the industry had made attempts to circumvent the system in multiple ways and that helped us learn how to catch importers who were using illicit means to bring their shipments into the U.S.”

The port of Charlotte team shared their knowledge with the area ports. “As we developed the operation, we reached out to other ports that would be affected—Wilmington, Morehead City, Raleigh, Winston-Salem, Greensboro—and we let them know what we were going to be doing,” said Sorrells. “Through our learning process, we developed team training and we were able to instruct the officers on what we were looking for, how we were going to work on this, and what we planned to do moving forward.”

It didn’t take long before the team received a suspicious shipment. “One of our officers targeted it randomly,” said Pazzo. “The shipment was described as a suitcase and it was coming from a company that had the word ‘technologies’ in its name, so it just didn’t fit.”

There were other red flags. “A suitcase has a very high duty rate. Twenty percent plus,” said Pazzo, “and the goods were in retail boxes that said, ‘Designed and assembled in the USA,’ when they came from China.”

When the team examined the merchandise, they saw that it wasn’t really a suitcase. “It may have looked like a suitcase, but it was actually a metal frame in the shape of a suitcase with a plastic handle on the top and it had an opening on the side where a solar cell could be inserted for mobile power once it was fully assembled,” explained Pazzo. “It was a misdescribed solar power unit that would be used in the event of a power outage.”

The port of Charlotte team sent a sample to the CBP Savannah lab to determine if the solar cells were the crystalline silicon type that were covered by the dumping order. “It was determined to be affirmative and approximately $6,600 in antidumping duties were due for that one entry,” said Pazzo.

Operation Solar Flare has been highly successful. During the original three-month operation in 2012, the potential loss in revenue owed to the U.S. government was $1.6 million. From August 2012 to April 2015, CBP recovered slightly more than $1 million in lost revenue because of classification errors and $6.5 million in antidumping and countervailing duties.

“Solar cell manufacturing is an evolving and struggling industry in the U.S. That is why it is so critical that we continue to do the work that we’re doing to protect U.S. industry,” said Pazzo.

Still there are other aspects that contribute to CBP’s holistic approach to preventing evasion of dumping orders. One is a specialized targeting unit that works with industry and partner agencies to gather and analyze trade intelligence. The intelligence is shared with the ports and the Centers of Excellence and Expertise to implement better trade enforcement actions nationwide.

CBP’s Automated Commercial Environment, ACE, cargo processing system also helps the agency validate shipment activities and recover revenue. “We do shipment document reviews through our cargo processing system electronically to see if the information supplied by brokers and importers is accurate and to check for any discrepancies,” said Amdur, who heads CBP’s antidumping and countervailing duty policy branch. “The reviews resulted in the recovery of approximately $22.7 million in revenue for solar cell and panel shipments from March 2012 through February 2015.”

Closing the loophole

But CBP faced another major enforcement hurdle that proved to be a bigger challenge. The dumping orders had a loophole. As long as Chinese manufacturers used non-Chinese solar cells, their products were duty-free. As a consequence, Chinese solar panel imports in the U.S. skyrocketed, increasing by more than 1600 percent between 2011 and 2013.

“China just changed its unfair trade practices to using Taiwanese solar cells, but their products were still dumped and subsidized,” said Brightbill. “It was very difficult to enforce, because the product comes in a panel that is labeled with the country of origin, but the cells do not have any indication of what country they’re coming from,” he said. “While the first trade cases did result in some reduction in the amount of Chinese product coming into the country, solar panel prices continued to go down very significantly and there was more harm to U.S. industry. More producers were shutting down, there were no new producers opening up and those that were still around were losing money.”

“By 2013, the Chinese came pretty close to making the solar industry extinct in the United States,” said SolarWorld’s Dulani.

As a result, on Dec. 31, 2013, SolarWorld filed a second set of petitions. This time the trade case was against China and Taiwan. A year later in December 2014, after a rigorous investigation, the Department of Commerce issued its final determination. “Our analysis showed that companies from China and Taiwan were dumping solar cells and solar panels in the United States and that the government of China was providing countervailable subsidies,” said Christian Marsh, deputy assistant secretary for antidumping and countervailing duty operations for the U.S. Department of Commerce. A few months later, in February 2015, following its own investigation, the International Trade Commission also found China and Taiwan guilty of violating trade laws. New dumping orders were issued, new duties were put in place on additional products, and the loophole was closed.

Moving swiftly

Even before the second dumping order was finalized, CBP was moving swiftly to step up its trade enforcement. Katie Schultz at the port of Portland had reopened a sting operation she had worked on in 2012. She also decided to take another look at the solar importers she had focused on earlier. “I went back to the companies I had looked at previously to check their new shipments, to see if they were doing things the same way or if they were sourcing their solar cells from somewhere new,” said Schultz. That’s when Schultz noticed a company she hadn’t seen before. “They were all pretty much the same importers except one new company based in Los Angeles,” she said.

Schultz immediately started to review the company’s shipments to see where they were getting their product from and what claims they were making. “The first documents they submitted were inconclusive, so I contacted them and they didn’t respond. That really rang all of my bells. Something was not right here,” said Schultz.

Eventually Schultz made contact with the importer, but there were long breaks in the communication, the company requested several extensions, their documents were incomplete, and they kept switching brokers. “However, the real kicker,” said Schultz, “was the shipments should have been sent to L.A. for an L.A. project. I couldn’t understand why they would be bringing the shipments to Portland and then transporting them down to L.A., and they were using a different broker to do it.”

All of those things combined made Schultz suspicious. “It made me think they could be transshipping goods through another country or bringing shipments in to different ports thinking CBP can’t track them. However, we can,” she said.

Through her research, Schultz discovered that the importer had sent 13 shipments through the port of Portland since May 2014. She also determined that several of the shipments were in violation and the potential lost revenue owed to the U.S. government was approximately $32.6 million.

Bright future

During the last year, signs of a brighter future have been unfolding for U.S. solar manufacturers. According to a Jan. 15, 2015, article published by Greentech Media, an industry news/research source, the third quarter of 2014 saw domestic solar panel production spike 275 percent since the market collapse in 2012. “We’re seeing a real resurgence in solar manufacturing in the U.S.,” said Brightbill. “Now that the unfair trade practices are being addressed, we expect to see tremendous growth in manufacturing. And it makes sense because the demand for solar energy in the United States by the residential, commercial and utility sectors is extremely strong. It’s not just growing by double digits, but in some cases by triple digits every year. It’s a very strong market. We should be adding five to 10 new manufacturers a year and thousands of jobs.”

SolarWorld, which celebrated its 40th anniversary in June, is one of the companies making a comeback. “We are rehiring 200 people. By the third quarter of this year, we will have hired everyone. Our goal is basically to finish by August,” said Dulani. When complete, SolarWorld’s employment in Hillsboro will return to 900 workers.

The company will also be expanding its production volume. A new solar-panel production line will be added, increasing the factory’s annual capacity from 380 megawatts, MW, to 530 MW. SolarWorld also will be expanding its advanced, high-power cell production capacity by 100 MW.

Other solar manufacturers such as Silicon Energy, a small niche company with facilities in Marysville, Washington, and Mt. Iron, Minnesota, also have plans for growth. “We are in the process of getting ready to hire more people in Minnesota,” said Gary Shaver, Silicon Energy’s president. “We’re looking at 2016 as a year of significant growth for us. Our hope is to increase by at least 50 percent next year.”

Not long ago, the company was fighting for its survival. “In Minnesota we went up against a company that was importing from China. It really damaged our company to the level that we’re lucky we’re even here,” said Shaver.

Then, there are others such as Suniva, a Georgia-based crystalline silicon solar cell manufacturer that opened its second U.S. manufacturing plant in Saginaw Township, Michigan, last year. As reported in the Atlanta Business Chronicle in July 2014, “Suniva is following a growing trend of manufacturing returning to the U.S.” from overseas. Suniva plans to add 350 new jobs to the Saginaw community.

SolarCity, the largest residential solar installer in the U.S., is also joining the domestic solar panel manufacturing ranks. The San Mateo, California-based company, chaired by entrepreneur Elon Musk, broke ground last September in Buffalo, New York, for a manufacturing facility that is being billed as one of the world’s largest with more than 1 gigawatt, GW, of capacity. 1 GW can power up to 750,000 homes.

According to company spokesman Will Craven, “several thousand people” will be hired to work at the new facility, which will open in 2016. “The factory is scheduled to be at full production by the end of the first quarter of 2017,” said Craven. “Most, if not all, of the volume will initially be used in the U.S. by SolarCity’s more than 190,000 customers.”

“The growth that we’re seeing in U.S. solar manufacturing today would not have been possible two, three or four years ago when Chinese imports were crushing what was left of U.S. industry,” said Brightbill. “It is a remarkable turnaround in a very short amount of time for an extremely important industry since renewable energy is such a growth market both here in the United States and around the world.”

SolarWorld president Dulani credits the U.S. government for his company’s turnaround. “Because of the support from CBP, the Department of Commerce, and the legal process, which works in the United States, we won our second trade case,” he said. “Without the help of the government and CBP, it would be hard to keep these 700 jobs here—forget about expanding. But,” he said, “if the enforcement isn’t there, then these orders don’t mean anything.”

“The CBP staff invested time to understand our product line and how it works. They participated in webinars and came to tour our factory while the trade cases were going on. They were eager to learn and asked so many questions about our products. That showed us that they truly care and want to enforce our trade laws,” said Dulani. “And this is important, because if CBP employees understand the product line, it’s easier for them to enforce the trade laws and our company’s employment will be in safe hands at the border.”